On 23rd May 2022, OBA Academy arranged a half-day workshop with KPMG on VAT in the Financial Service Industry. 17 executives from 15 banks registered to attend this session.

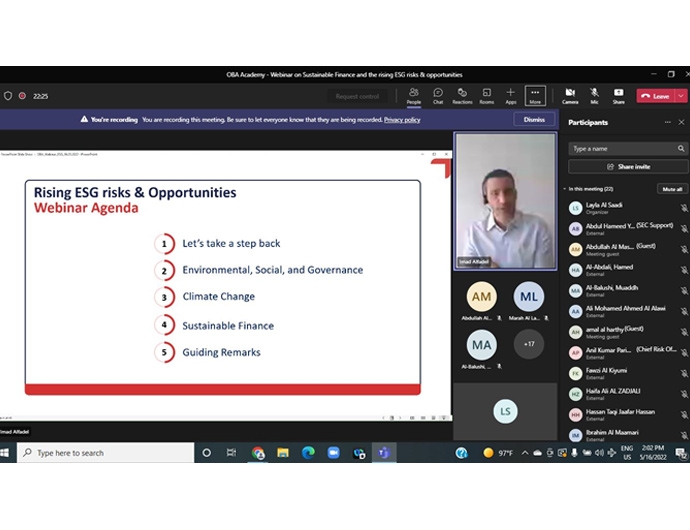

A virtual workshop was held on 16th May 2022 titled 'Sustainable Finance and ESG Rising Risks & Opportunities' conducted by ESG Integrate Consultancy. The session was attended by around 40 bankers.

Two-day course on Customer Service Excellence was held on the 13th and 14th March 2022. This was pay per participant course attended by a number of participants.

On 14th March 2022, OBA Academy hosted Mr. Omar Ansary, Secretary General, Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI) in its series of 'Meet The Expert'.

The discussion revolved around strategic and operational challenges involving the adoption and implementation of AAOIFI standards. Specific topics covered during the session were, as follows:

The event was attended by around 70 senior executives from the banking community and CBO.

Topic: Overview of Environmental, Social, and Governance (ESG) from a Banking Perspective

Agenda

The session took place on 25th October 2021, attended by a number of senior bankers. Mr. Amin Al Husseini, ex. CEO Oman Arab Bank, is now engaged with the private corporate sector and had been consulting companies during the difficult COVID times. During the session, Mr. Amin provided insight on challenges facing corporates.

The topics covered were:

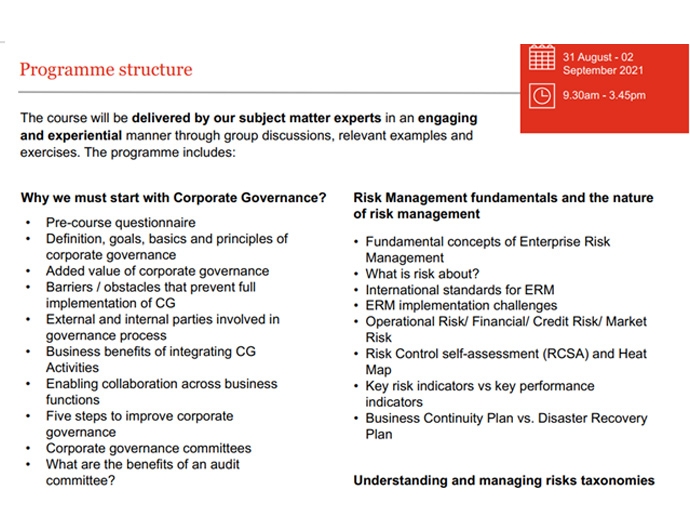

A wide range of risk management topics were covered, such as, roles and responsibilities of risk champions, risk management fundamentals & guidelines, corporate governance, BCP, risk taxonomies, compliance, and internal audit.

The second session in Meet the Expert series was held on 13th September 2021 with Mr. Khalid Al Kayed, CEO Bank Nizwa. His main topic was the journey of Islamic Banking in Oman. The session was attended by 77 senior bank executives including OBA Chairman, 4 bank CEOs, and CBO plus CMA executives. Feedback received on Meet The Expert series was indeed encouraging.

This 3-day programme commenced on 31st August and will run until 2nd September 2021. The programme will cover a wide range of topics, such as, the roles and responsibilities of risk champions, risk management fundamentals & guidelines, corporate governance, BCP, risk taxonomies, compliance & internal audit, and many other risk management related topics. 18 executives registered to attend this training.

Based on a recommendation by OBA's HR Committee, OBA Academy arranged for a one day session on 9th August 2021, presented by known HR experts who had published a number of books and numerous research papers; Prof. Dave Ulrich from University of Michigan and Prof. Patrick Wright from the University of South Carolina USA. 23 HR executives attended this session.

The first invitee to speak at this exclusive series of webinars was Dr. Adnan Ahmed Yousif, Chairman of Bahrain Association of Banks and former President/CEO of Al Baraka Banking Group. Dr. Adnan has over 30 years of experience in banking and had shared some insights covering a wide range of topics during this live webinar that took place on 26th July 2021. More than 40 senior bankers attended this session including OBA Chairman, a number of bank CEOs, and executives from regulatory bodies.

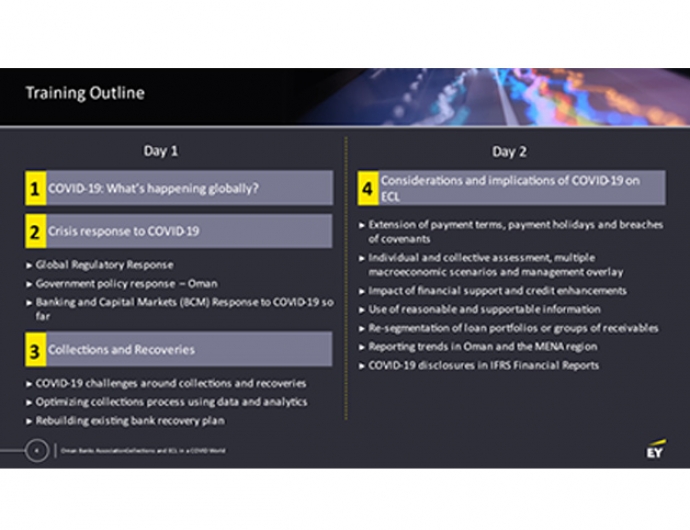

Twenty-eight bank executives from seven banks attended this pay-per-participant program.

The webinar was attended by 19 banking executives from 6 banks. This was a pay per participant workshop.

Certified CISO is a highly specialized training and certification program aimed at producing top-level information security executives. The program focused on the application of information security management principles from an executive management point of view including Governance, Risk Management, Compliance, Information Security Controls, Information Security Core Competencies, and Strategic Planning.

The program was attended by information security executives from a number of banks as well as the CBO and CMA.

Sohar Port Freezone presented its modus operandi and investment opportunities at the free zone. This was followed by a discussion with senior bankers on challenges faced by international investors when dealing with certain banking transactions. Twenty-one executives attended this event.