The session focused on key strategies for embedding customer-centric practices across all levels of an organization. Topics included assessing current customer experiences, aligning business operations with customer needs, and implementing sustainable customer-centric strategies. Participants were left with a clear roadmap for developing and executing a customer-centric strategy tailored to their organization's specific goals and challenges.

The Customer Journey Mapping took place on the 22nd and 23rd of October 2024 at the OBA office which was attended by banks where they learned both the fundamentals and the latest model to embed customer-centricity across cross-functional teams, ensuring sustainable, organization-wide immersion in customer experience. The session included hands-on group work, where participants applied their learning to create journey maps. By the end of the session, attendees were equipped to apply customer journey mapping practices effectively within their own organizations.

The course took place from 13th to 17th October 2024 and provided the security operatives, officers, and managers with the fundamentals of conducting effective security operations. It addressed a wide variety of topics to enable all participants to understand and practice the skills required to carry out day-to-day security functions.

The course participants gained practical skills and techniques that can be implemented immediately back in the workplace.

The session was in collaboration with Meirc Training & Consulting firm based in Dubai.

The expert Mr. Scott Livermore spoke about Global Macroeconomics with Focus on Oman under Volatile time. The Oman Economist at Oxford, Ms. Maya Senussi also joined the session online to give more focused insights on Oman.

The session was hosted by NBO and attended by the OBA treasurers committee and other members both in person and online.

During the last week of September, OBA hosted the second course in collaboration with Meric Training Institute for 5 days. The Security Policies and Procedure course was for the banking risk experts to give them a deep understanding of the policies and procedures needed for security departments within their banks. Specifically, participants discussed managing the implementation and evaluation of their policies and procedures about setting standards, staff safety, security effectiveness, and overall performance of the security department.

The Certification in Fundamentals of Security Management Course, held from September 3rd to 5th, 2024, proved to be a great success, attracting a robust group of participants primarily from the Risk Management and Information Security sectors of different banks. Over the three-day program, attendees engaged deeply with the material, gaining invaluable insights into the principles and best practices of security management. The lecturer's expertise and ability to convey complex concepts in an accessible manner significantly enhanced the learning experience, fostering dynamic discussions and networking opportunities among participants. The positive feedback received highlights the course's critical role in equipping professionals with essential skills to navigate the evolving landscape of security challenges in the banking sector.

During the course, participants explored how incident management works and how individuals and teams can successfully implement and apply principles within their organizations and/or work environments. Incident Management involves returning your organization’s everyday business safety, productivity, and overall operation, to normal as quickly as possible after an incident.

OBA in collaboration with Deloitte hosted a one-hour session with the banks on VAT strategies and compliance in the Oman Banking Sector. The session highlighted an overview of VAT in Oman; current issues and the new landscape in the banking sector, KSA/UAE VAT experiences and observations in the banking sector, and the E-invoicing experience followed by an open discussion.

On 13th May 2024, Ms. Lina Osman, the Regional Head of Sustainable Finance, West at Standard Chartered Bank hosted the OBA Academy’s Meet the Expert series to present to the members about Sustainable Financing Tools. The session was attended by several executives and CEOs from the banking sector where Ms. Lina shared her knowledge of Sustainable Financing and her experience in the field.

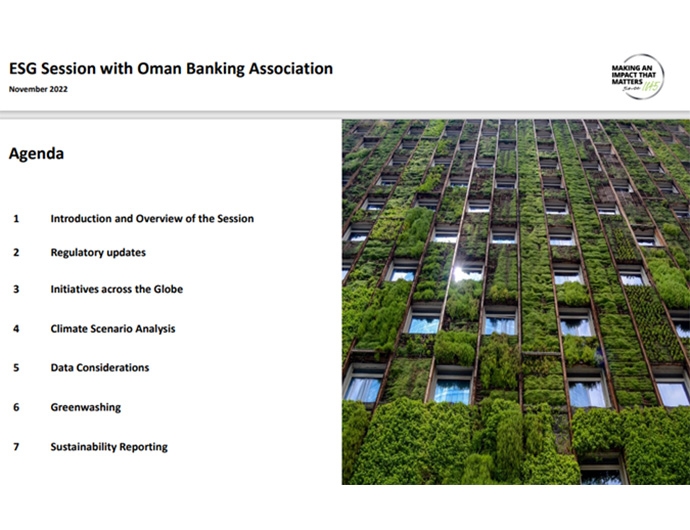

أقيمت هذه الندوة الافتراضية عبر الإنترنت في 30 مارس 2023 وحضرها 30 مديرًا تنفيذيًا من البنوك.

عُقدت هذه الجلسة الافتراضية في 30 يناير 2023 وحضرها 64 مديرًا تنفيذيًا من البنوك.

تم عقد هذا البرنامج الذي مدته 3 أيام من 18 - 20 ديسمبر 2022 في مكتب جمعية المصارف العمانية، وحضر 4 من المسؤولين التنفيذيين في البنوك برنامج الشهادة هذا.

عُقدت هذه الجلسة الافتراضية التي طلبتها لجنة الامتثال التابعة لجمعية المصارف العمانية في 12 ديسمبر 2022 وحضرها 41 مسؤولًا تنفيذيًا من البنوك.

عمان &الولايات المتحدة: محددات أسعار الفائدة والتضخم في 15 نوفمبر 2022.

قابل الخبراء: منصات ائتمان قابل التكنولوجيا المالية، وجوانب وعوامل المخاطر المتوقعة ، 3 نوفمبر 2022.

عقدت ندوة يوم 27 يوليو 2022 حول قانون الشركات التجارية وقانون حماية البيانات الشخصية من قبل أديلشو جودارد، وحضرها عدد من المسؤولين التنفيذيين في البنوك. أقيم هذا الحدث في المقر الرئيسي لبنك أبوظبي الأول (FAB1) في الحي التجاري.

عقدت هذه الندوة الافتراضية في 23 يونيو 2022 وحضرها أكثر من 20 من كبار المصرفيين، وعرض مقدم الندوة محتوى مثيرًا للاهتمام وتبع العرض جلسة أسئلة وأجوبة.

عقدت ورشة العمل في 22 يونيو 2022 بمركز تدريب شركة تنمية نفط عمان في ميناء الفحل، وحضرها مصرفيون من الشركات الصغيرة والمتوسطة ورجال الأعمال وأصحاب المشاريع الصغيرة والمتوسطة والبنك المركزي العماني وغرفة تجارة عمان وريادة ووحدة متابعة تنفيذ رؤية عمان 2040، وناقشت ورشة العمل مختلف التحديات التي واجهها رواد الأعمال وأصحاب المشاريع الصغيرة والمتوسطة بعد انتشار الوباء، وكان الهدف هو خلق حوار حول "مجالات الصعوبة" التي يواجهها أصحاب المشاريع الصغيرة والمتوسطة لغرض اقتراح خارطة طريق. يرتبط عدد من هذه التحديات بالتمويل والعلاقة مع البنوك.